- Reserve Bank of India leaves repurchase rate unchanged at 4%

- Indian Rupee (INR) edges lower after investors are disappointed by RBI’s lack of guidance on debt purchases and economic growth

- US Dollar (USD) moves southwards versus major peers amid growing concerns over the labour market recovery

- US initial jobless claims to show 1.41 million vs 1.43 million last week

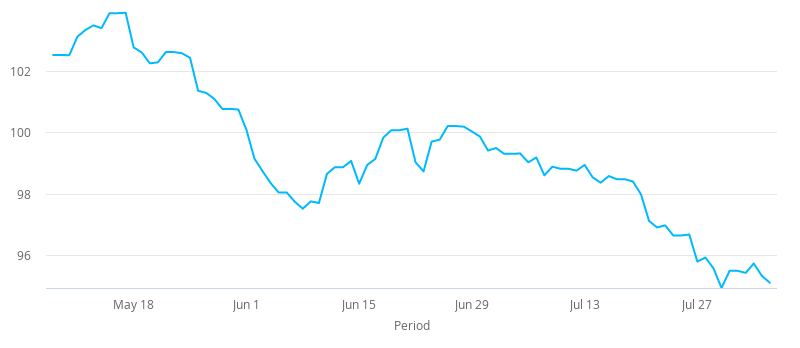

After two sessions in decline the US Dollar Indian Rupee (USD/INR) exchange rate is gaining altitude on Thursday. The pair settled on Wednesday -0.35% at 74.79. At 10:00 UTC, USD/INR trades +0.2% at 74.95 after having briefly pierced through the key 75.00 level.

The Reserve Bank of India kept the repurchase rate on hold at 4% in July as it sought to strike a balance amid rising retail inflation and keeping monetary sufficiently loose to aid economic growth.

The Governor of the Reserve Bank of India Shaktikanta Das confirmed that there was still space for further monetary policy easing. However, the central bank is looking for inflation to cool before taking further steps to support the economy.

The central bank has already cut repo rates by 115 basis points since February, this was in addition to 135 basis point cuts made in an easing cycle last year.

The Monetary Policy Committee highlighted the uncertain nature of the outlook for inflation and the economy amid the ongoing coronavirus crisis. However, it was the absence of guidance on debt purchases and the extent of the economic slowdown which left investors disappointed. Whilst Shaktikanta Das said GDP is set to contract in the fiscal year through to March 2021 he didn’t give a specific forecast.

The US Dollar is trading lower versus its major peers heading towards the US open. Concerns are growing that the US economic recovery and more specifically the recovery in the labour market is stalling as coronavirus cases continue to rise.

After yesterday’s ADP data showed that the number of new jobs created in the US private sector slowed sharply in July, investors are looking cautiously ahead to today’s initial jobless claims. Expectations are for 1.41 million Americans to have signed up for unemployment benefits, only a slight improvement on last week’s 1.43 million.