|

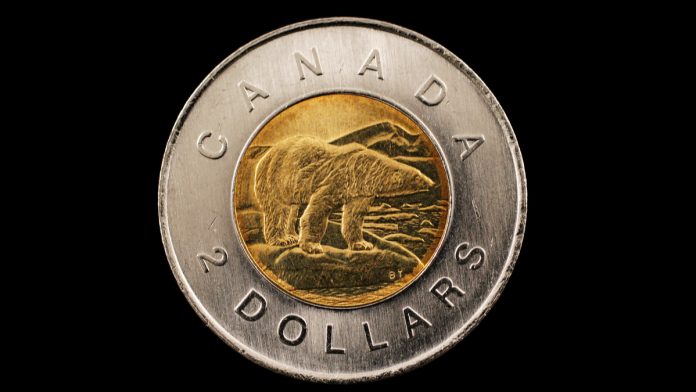

GBP/CAD declines on Tuesday after a long-lasting rally that started on November 7. The pair just broke the support line of the uptrend, and the chances are that the decline will continue.

Currently, one British pound buys 1.7078 Canadian dollars, down 0.15% as of 9:35 AM UTC. Yesterday, the pair hit the highest level since May 21. The pound was driven by Brexit optimism, as UK polls showed that the ruling Conservative Party was in a much better position versus the opposition Labour Party for the national election scheduled for December 12.

Besides, UK Prime Minister Boris Johnson pledged to support domestic businesses through tax cuts and other measures.

The uncertainty and pessimism surrounding the US-China trade relationship added to the pressure on the Loonie, which benefited the pound.

However, some glimpse of hope came back on Tuesday, forcing the GBP/CAD pair to depart from its recent high. On Monday, Goldman Sachs analysts wrote in a note that the pressure from the Sino-US trade conflict will ease next year, giving the global economy more freedom to accelerate growth.

Besides, China’s central bank is ready to implement some stimulus to boost the economy, with analysts arguing that the measures will help the global economy as a whole.

Yi Gang, governor of the People’s Bank of China (PBOC), said that the bank would increase credit support to the country’s economy by cutting real lending rates. The move comes shortly after the central bank cut its short-term funding rate for the first time in four years.

The PBOC will present its interest rate decision tomorrow morning. According to Reuters, a recent survey showed that all 64 respondents expect a reduction in the one-year loan prime rate (LPR), while 37 respondents anticipate another cut in the five-year LPR.

Lu Ting, Nomura Hong Kong’s chief China economist, commented:

“As the one-year MLF rate is the benchmark for the LPR, we expect the one-year LPR to be cut by slightly more than 5 bps on Nov. 20 from 4.20% per annum currently.”

|